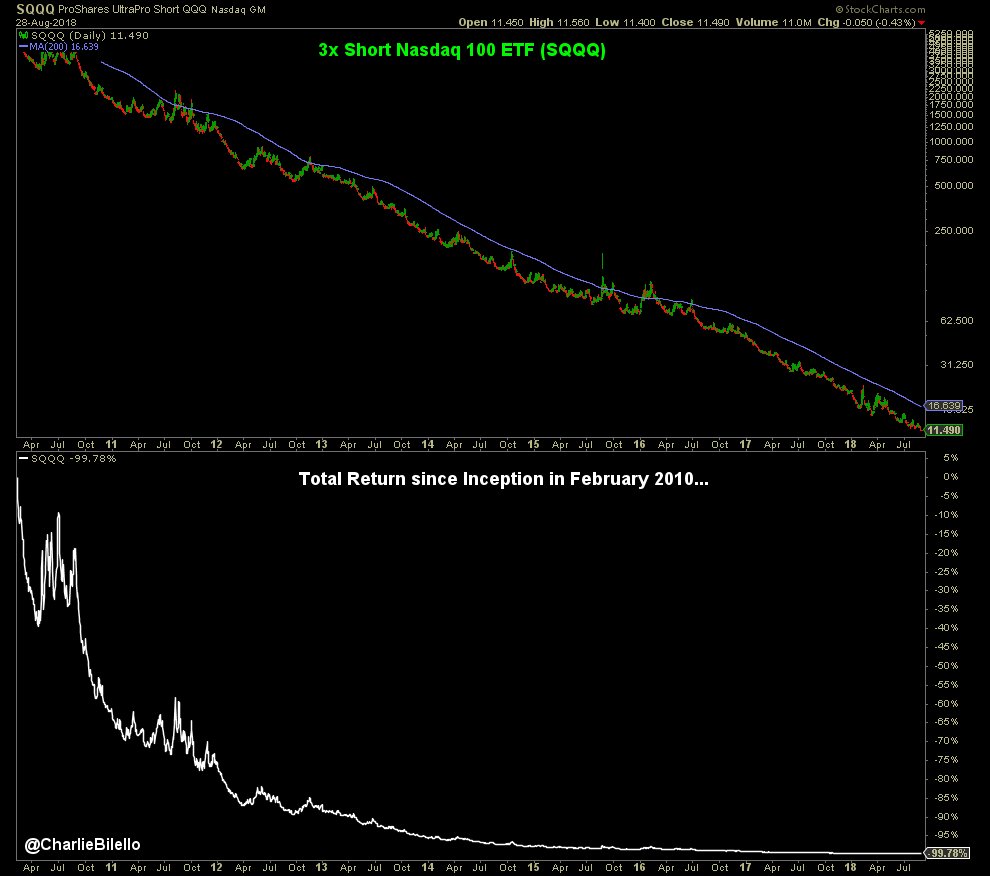

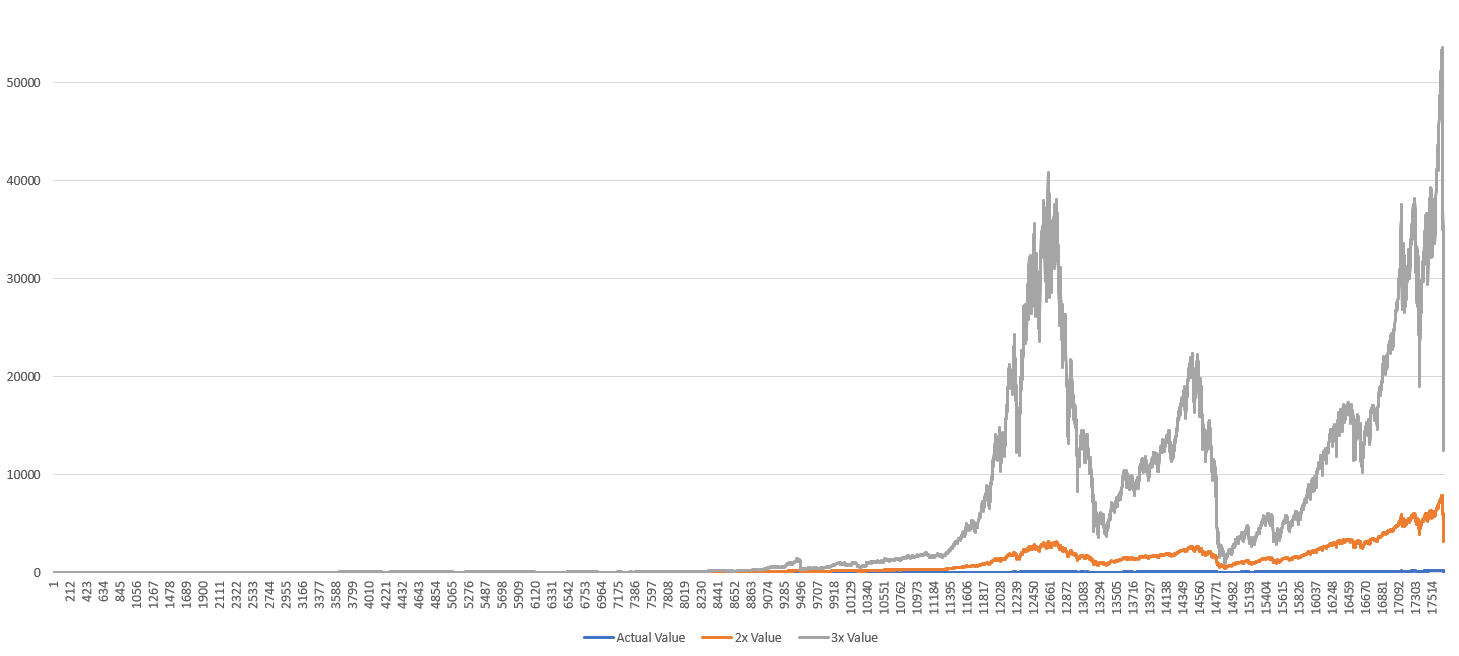

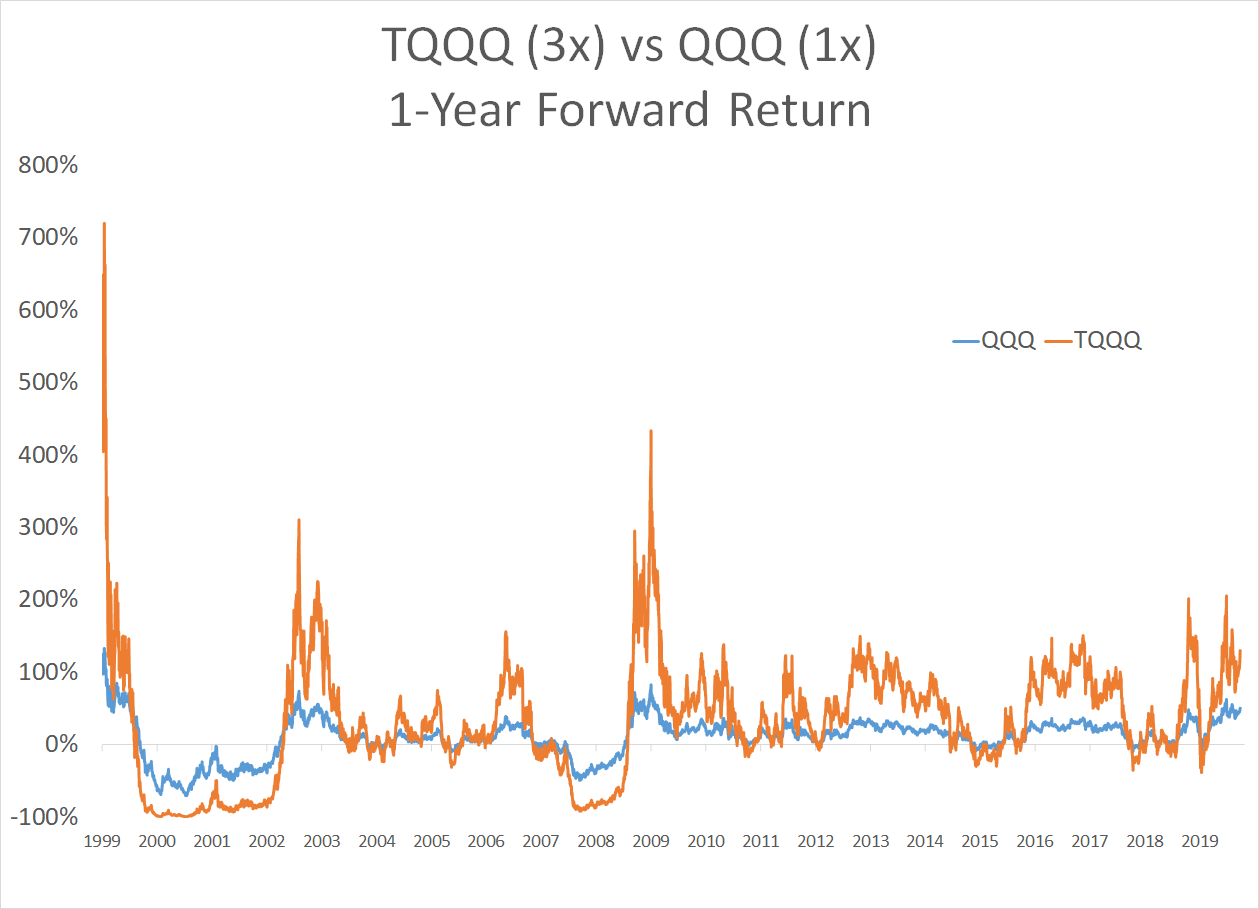

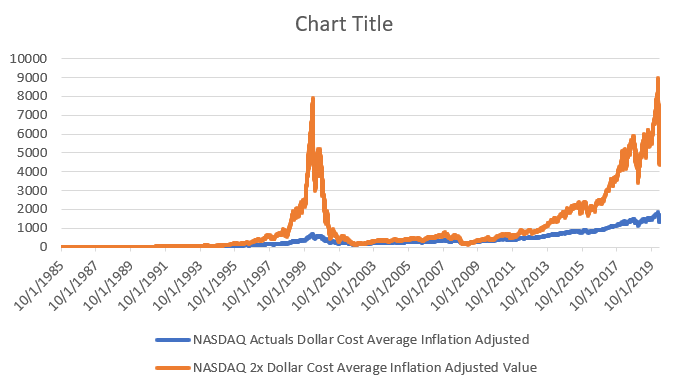

Charlie Bilello on Twitter: "3x Long Nasdaq 100 ETF Returns... 2010: +89% 2011: -8% 2012: +52% 2013: +140% 2014: +57% 2015: +17% 2016: +11% 2017: +118% 2018: -20% 2019: +134% 2020: +110% 2021 YTD: +60% Total Return since inception: +16,730% $TQQQ Data ...